With just a few taps on your smartphone, you can deposit checks, pay bills, and manage your finances without ever stepping foot in a bank. But did you know there are hidden features so check cashing apps that most users never even realize exist?

According to a recent report from the Consumer Financial Protection Bureau, the use of check cashing apps has surged, with many people opting for these convenient tools to handle their finances. A report by The Financial Brand recently revealed that the use of mobile check cashing has increased by over 50% in just two years.

However, beyond the surface-level features like depositing checks and viewing balances, there are a host of advanced options that can streamline your money management even further.

Let’s dive deep into the 7 hidden features that can change the way you handle your finances. Whether you’re in Texas or across the USA, these insights will help you unlock the full potential of your check cashing app.

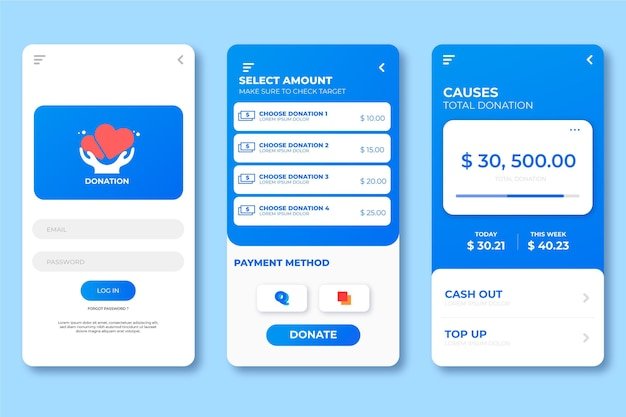

What Are Check Cashing Apps?

These are mobile applications that allow users to cash checks remotely, often without needing to visit a physical bank. These apps are revolutionizing how people access their funds, offering speed, convenience, and flexibility. With just a photo of the check and a few taps, the money can be available in your account almost instantly, depending on the app and the service plan.

The Rise of Check Cashing Apps in Texas

Texas has been a leader in adopting apps, particularly in urban areas like Houston, Dallas, and Austin. These apps are popular with small business owners, gig workers, and individuals looking for quick access to their money. With the state’s large population of self-employed individuals, check cashing apps provide a vital service.

7 Hidden Features of Check Cashing Apps

While most users are familiar with the basics, there are hidden features that can significantly enhance your experience. Here are seven that you need to know:

1. Instant Balance Check Without Logging In

Many check cashing apps now offer the ability to check your balance instantly without needing to log in. This feature, often available in the app’s settings, saves time when you’re on the go.

2. Scheduling Future Check Deposits

Some apps allow users to schedule future deposits for recurring payments. This feature is great for freelancers or businesses that receive regular checks from clients.

3. Split Deposits Between Accounts

A lesser-known feature is the ability to split a deposit between multiple accounts. For example, you could deposit part of a check into your savings and the rest into your checking account.

4. Auto-Pay Integration with Bills

Several check cashing apps integrate with bill-paying services, allowing you to automatically allocate funds toward bills like utilities or credit cards as soon as a check is deposited.

5. Multi-Language Support for a Diverse Audience

Many apps now offer multi-language support, including Spanish and Chinese, making them more accessible to a wider range of users across the U.S., particularly in Texas.

6. Secure Check Verification Alerts

Some apps notify you immediately if there are any issues with your check, such as a potential fraud warning or incorrect information. This feature adds an extra layer of security.

7. Real-Time Transaction Monitoring

Finally, many check cashing apps offer real-time transaction monitoring. This allows you to keep track of where your money is going and when, all in one easy-to-use interface.

Popular Check Cashing Apps

PayPal’s Check Cashing Feature

PayPal offers check cashing directly through its app. Users can deposit checks quickly, and funds can be made available almost instantly for a small fee.

Ingo Money App

Ingo Money is one of the most popular check cashing apps, allowing users to deposit checks and choose where the funds are sent—whether it’s to a bank account, PayPal, or prepaid cards.

ACE Cash Express App

ACE Cash Express is a Texas-based service with a dedicated app that allows users to cash checks, pay bills, and manage loans—all from their mobile device.

Blueprints Digital Center: Streamline Your App Development

If you’re looking to develop your own financial or check cashing app, Blueprints Digital Center is here to help. With our team of expert developers, we offer end-to-end solutions that bring your app ideas to life. Whether it’s building custom features, optimizing security, or designing a user-friendly interface, we have the experience to create an app that stands out in the market.

We don’t just build apps—we create solutions that work for your business. Let’s make your app the tool that sets you apart.

FAQ’s

1. What is the best check cashing app for fast access to funds?

The Ingo Money App is a popular choice for instant deposits. While there is a small fee, it allows for immediate access to funds.

2. Are check cashing apps secure?

Yes, most check cashing apps prioritize security with features like encryption, secure login, and real-time fraud alerts. Always ensure you’re using a trusted app with these features.

3. Can I deposit checks into multiple accounts using check cashing apps?

Yes, many apps, including Ingo Money and PayPal, allow you to split deposits between multiple accounts for easy budgeting.

4. Are there any fees associated with check cashing apps?

Most check cashing apps charge a small fee for instant deposits, while free options are available if you’re willing to wait a few business days.

5. How can I get started with developing a financial app for my business?

Contact Blueprints Digital Center to discuss your app development needs. Our team of experienced developers can help you create a custom solution tailored to your business goals.