Custom software development has a crucial role in the ever-evolving financial sector. Mobile banking apps have become an essential part of modern life. Consumers expect seamless, secure, and easy-to-use mobile experiences to manage their finances. Whether it’s transferring funds, checking account balances, or even making investments, users want to handle it all with just a few taps. For businesses, this means developing a high-performing mobile banking app is no longer a luxury — it’s a necessity.

The solution? Custom software development. Tailoring an app specifically to your users’ needs ensures that your mobile banking app isn’t just functional but also a key driver of customer satisfaction and business growth.

Let’s dive into the process of custom software development for mobile banking apps, and how it can transform your financial services.

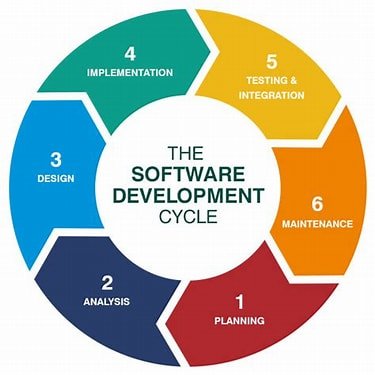

Steps in Custom Software Development for Mobile Banking

Custom software development stands out because it gives you the flexibility to design and build solutions that meet your exact requirements. No generic, off-the-shelf software can deliver the same personalized user experience, security, or features that custom development offers.

Here’s a quick overview of the development journey for creating a mobile banking app, with an added flowchart to visualize the steps:

- Conceptualization & Requirements Gathering

- UX/UI Design

- Prototyping & Development

- Security Implementation

- Testing & Quality Assurance

- Deployment & Integration

- Ongoing Maintenance & Updates

Flowchart: Custom Software Development Process

[Concept & Requirements] —> [Design UX/UI] —> [Prototyping] —> [Security Implementation] —> [Development] —> [Testing] —> [Deployment] —> [Maintenance]

1. Conceptualization & Requirements Gathering

The first step in custom software development is understanding what your app needs to do. For mobile banking, this could include:

- Real-time balance checks

- Fund transfers between accounts

- Bill payments

- Loan applications

- Customer support

This stage involves market research, user surveys, and stakeholder input to ensure your app is designed to meet specific customer needs. Think of it as laying the groundwork for everything that follows.

2. UX/UI Design

Designing the user experience (UX) and user interface (UI) is where creativity meets practicality. A well-designed mobile banking app should make financial management feel intuitive. This is where custom software development shines — every button, menu, and screen is built to provide a smooth, frustration-free experience for users.

For example, when Bank of America revamped its mobile app, they focused heavily on creating a personalized dashboard that would allow users to see all their essential banking activities in one place. This kind of tailored design enhances user engagement and satisfaction.

3. Prototyping & Development

Once the design is locked in, a prototype is created. This interactive mockup allows stakeholders and users to get a feel for the app before it goes into full development. This stage allows for early testing and feedback, minimizing costly changes later on.

Custom software development for mobile banking typically involves multiple technologies:

- Front-end: This is what users see and interact with. It needs to be responsive and compatible with all devices (iOS and Android).

- Back-end: This is the brain of your app, managing user data, transactions, and more.

- APIs: These allow your app to communicate with other software (like banking databases or third-party services).

Flowchart: Tech Stack for Mobile Banking App

[Front-end (iOS/Android)] —> [Back-end (Databases, User Management)] —> [APIs (Third-Party Integrations)]

4. Security Implementation

When dealing with financial data, security is the most crucial element. Here are a few must-have features that custom software development can offer for mobile banking apps:

- Biometric Authentication (fingerprint, facial recognition)

- Two-Factor Authentication (2FA)

- End-to-End Encryption

- Real-Time Fraud Detection

These security measures ensure that sensitive user information is protected from threats like hacking, identity theft, and fraud. According to a recent survey by McKinsey, security concerns are one of the top reasons why consumers hesitate to use mobile banking apps, so addressing this upfront is key.

5. Testing & Quality Assurance

No app can go live without rigorous testing. This step identifies bugs, security vulnerabilities, and performance issues. Custom software development allows for thorough testing that goes beyond what pre-built solutions offer. You’ll be able to fix potential problems before users ever see them.

6. Deployment & Integration

Once your mobile banking app has been thoroughly tested, it’s time to launch. Custom software development allows for seamless integration with your existing systems, like CRMs, accounting software, and other internal tools. This ensures a smooth transition for both your business and your users.

7. Ongoing Maintenance & Updates

The work doesn’t stop after launch. Mobile banking apps need continuous updates to improve functionality, add new features, and ensure security patches are up to date. Regular maintenance ensures your app remains competitive in an ever-changing digital landscape.

Benefits of Custom Software for Mobile Banking

| Feature | Benefit |

| Tailored User Experience | Personalize app features to fit specific user needs. |

| Scalability | Easily add new features as your user base grows. |

| Advanced Security | Protect user data with custom security protocols. |

| Seamless System Integration | Easily integrate with other financial tools or CRMs. |

| Competitive Edge | Stand out with unique, custom features. |

Conclusion

Building a secure, user-friendly mobile banking app doesn’t have to be overwhelming. With Blueprints Digital Center, we’ll guide you through every step of the custom software development process to create an app that meets your business goals and exceeds customer expectations. Ready to bring your mobile banking app idea to life?

Contact Blueprints Digital Center today and get started with a free consultation.