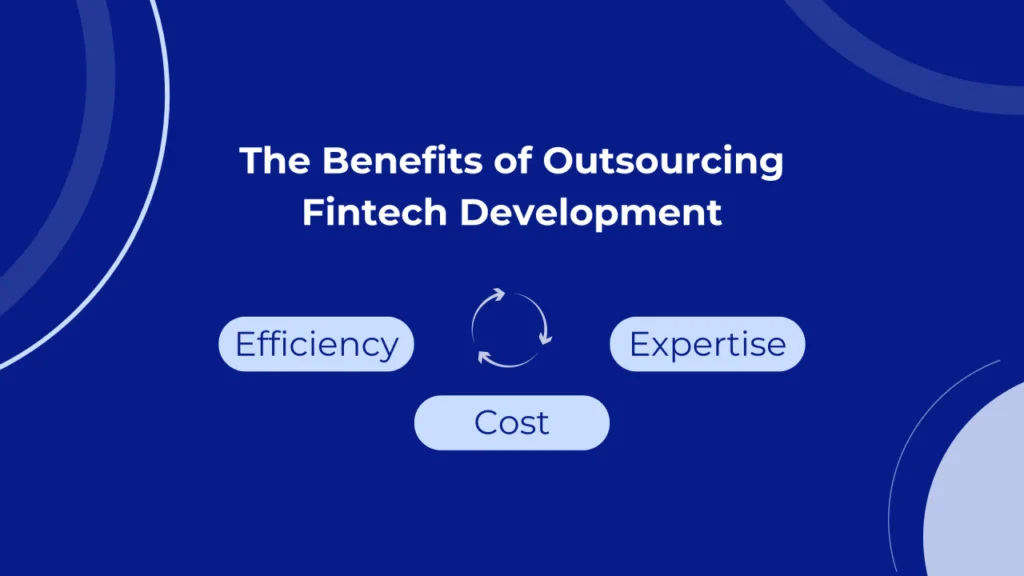

The global fintech landscape is evolving at breakneck speed, and outsourcing has emerged as a powerful tool for companies to stay competitive. In 2024, the fintech outsourcing market is expected to grow by 20.5% due to increasing demand for digital financial services, regulatory pressures, and the need for advanced technology. Whether you’re a startup looking to launch quickly or an established company seeking to scale, outsourcing fintech development can help boost efficiency, reduce costs, and accelerate growth.

Why Outsource Fintech Development?

1. Cost Efficiency

Outsourcing allows fintech companies to access highly skilled developers from countries with competitive labor costs. Countries like Vietnam and India offer expert talent at significantly lower costs than Western markets. This can free up capital to invest in other strategic areas, such as product innovation or customer acquisition.

2. Access to Specialized Expertise

Fintech solutions often require specialized knowledge in areas like blockchain, AI, and cybersecurity. Outsourcing firms with deep experience in these technologies can provide expertise that might be difficult or expensive to develop in-house. By partnering with the right fintech development provider, you can leverage the latest tools and trends to deliver cutting-edge products.

3. Faster Time to Market

Speed is critical in fintech, where the first mover often gains a significant competitive advantage. Outsourcing accelerates product development by giving companies access to experienced developers who can quickly turn ideas into fully functional products. Whether you need to develop a mobile payment app or a secure lending platform, outsourcing allows for faster execution.

Key Trends in Fintech Outsourcing

1. Artificial Intelligence & Machine Learning

AI and machine learning are increasingly becoming staples in fintech solutions. These technologies are being used to automate processes such as loan approval, fraud detection, and personalized financial advice. By outsourcing AI-driven development, fintech companies can quickly integrate intelligent systems into their platforms without having to build these capabilities in-house.

2. Blockchain Solutions

Blockchain continues to disrupt the financial industry by providing decentralized, secure, and transparent transaction methods. Outsourcing blockchain development allows companies to explore this technology without the need for internal blockchain expertise. Blockchain-based solutions can be used for everything from peer-to-peer lending to decentralized finance (DeFi) systems.

3. Cybersecurity

With the rise of digital financial services, security has never been more critical. Outsourcing allows fintech firms to partner with specialists who understand the latest cybersecurity threats and solutions. This helps ensure that user data is protected, and financial transactions are secure.

How to Choose the Right Fintech Outsourcing Partner

1. Experience in Fintech

Your outsourcing partner should have a proven track record in delivering successful fintech solutions. Ask about their previous projects and request case studies to ensure they understand the regulatory and technological challenges in fintech.

2. Technical Expertise

Look for companies that specialize in the technologies you need, whether it’s AI, blockchain, or cloud solutions. A team with expertise in fintech’s unique needs, such as regulatory compliance and security, will be crucial to your project’s success.

3. Communication and Collaboration

Fintech development often involves complex, long-term projects. Ensure your outsourcing partner is equipped for regular communication, transparent progress tracking, and has the ability to collaborate effectively with your in-house teams.

Advantages of Outsourcing in Fintech

| Benefit | Description |

| Cost Savings | Access to affordable, expert talent in various locations. |

| Specialized Expertise | Leverage cutting-edge technologies and fintech solutions. |

| Quick Time to Market | Speed up development and deployment with experienced teams. |

| Scalability | Scale resources up or down depending on project needs. |

Enhance Your Fintech Solutions with Blueprints Digital Center

Looking to build a robust, secure, and innovative fintech product? At Blueprints Digital Center, we specialize in fintech development outsourcing, providing world-class solutions that drive efficiency and growth. Let our experts bring your fintech vision to life.

Contact us today for a consultation!

FAQ’s

1. Why should I outsource fintech development?

Outsourcing allows fintech firms to reduce costs, access specialized talent, and accelerate development timelines, helping them stay competitive in a fast-evolving market.

2. How do I ensure the security of my fintech project when outsourcing?

Choose partners with strong security protocols and certifications, such as ISO 27001, and ensure contractual agreements include clear guidelines on data protection and security responsibilities.

3. What are the key trends in fintech development?

Key trends include the adoption of AI and machine learning, blockchain solutions, and enhanced cybersecurity practices.

4. How can outsourcing accelerate fintech development?

Outsourcing provides immediate access to skilled developers and advanced technologies, speeding up the time to market for new fintech products.

5. How do I choose the right fintech outsourcing partner?

Look for a partner with proven experience in fintech, technical expertise, and a strong track record of communication and collaboration.